LEGAL ADVICE

LEGAL ADVICE

From its very inception, our firm has been able to provide expert legal advice to international investors.

We have developed strong expertise in assisting foreign clients when they set up businesses or representative offices in France, and possibly in Japan, South Korea, China or in the United States.

We also have expertise in cross-border M&A, joint ventures and we assist our foreign clients involved in French or European disputes.

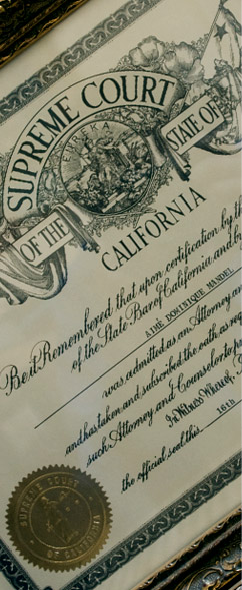

Mr. Aimé MANDEL, founding partner of the firm, has been admitted to the Paris Bar since 1973 and to the California Bar since 1975. He has represented his University since 1977, first for estates and donations issues and afterwards in trademark matters; as well as various American investors (medical and health consulting).

Since 1977, Mr. Aimé MANDEL has represented numerous Japanese governmental agencies and a vast array of Japanese manufacturers investing in France in various fields such as the audio industry, embroidery machines, farming and construction equipment, printing, sports articles as well as entertainment companies, golf and hotel businesses.

Many Japanese companies have chosen our firm to be their main corporate and labor law counsel.

For more than 15 years now, we have also assisted many South Korean companies for their investments in France in a variety of sectors.

In order to help our clients to set up their business abroad, our firm has also developed close ties with two independent law firms based in Japan and Spain respectively :

- The Japanese law firm AKASAKA INTERNATIONAL LAW PATENT & ACCOUNTING OFFICE, based in Tokyo (Japan), our firm having also strong connections with other firms in such cities as Osaka and Kobe ;

- The Spanish law firm of SENAKPON GBASSI ET ASSOCIES, based in Alicante (Spain), seat of the European Union Intellectual Property Office (EUIPO) – in connection with our EU Trademarks and Community Designs practice.

Our firm works harmoniously with local Counsels in many other jurisdictions, especially in China and in the United States.

Finally, in order to serve our clients all across Europe, our firm is an active member of EUROLEGAL, which is a network of European lawyers, whereby 16 countries are represented, including 22 law firms, 31 offices, and over 550 lawyers, practicing in all areas of business law.

LITIGATION: A BIRD’S EYE VIEW ON THE RECOGNITION AND ENFORCEMENT OF FOREIGN CIVIL AND COMMERCIAL JUDGMENTS AND INTERNATIONAL ARBITRAL AWARDS IN FRANCE

-

Introduction

‘There is a many a slip twixt cup and lip’, it would seem, if by obtaining a judgment or an arbitral award against a debtor, the winning party is unable to recover the allocated damages.

Our Firm, comprising lawyers of different nationalities (French, Japanese, South Korean and Chinese), all admitted to the French Bar (city of Paris) may boast having an international experience and a dual culture. Thus, we may assist our foreign Clients and/or their Attorneys in relation to the recognition and enforcement, in France, of foreign judgments and arbitral awards.

Foreign judgments shall mean either a judgment rendered by a court of another Member State of the European Union (EU) or a judgment rendered by a court of a country situated outside of the EU such as, for instance, a US or English judgment.

-

Judgments rendered by a court in another EU Member State

With regard to judgments rendered by a court in another EU Member State, the so-called “Brussels 1” EU Regulation No 1215/2012 of 12 December 2012 laid down the following paramount principle: mutual trust in the administration of justice in the EU justifies the rule that judgments given in a Member State shall be recognized and given ‘full faith and credit’ in all other EU Member States without the need for any special additional procedure.

In addition, the objective of making cross-border litigation less time-consuming and costly justifies the abolition of a declaration of enforceability prior to enforcement in another Member State.

Thus, a judgment given by the courts of a EU Member State shall be treated as if given in the other Member State where enforcement is sought.

As an example, a German or Spanish creditor who obtained against a French debtor a German or Spanish judgment which is enforceable in Germany or Spain, can directly enforce the said judgment in France without any prior declaration of enforceability.

Likewise, a settlement agreement, provided that it was formally entered before a Judge of one of the EU Member State.

Still, notwithstanding the effectiveness of the Brussels 1 Regulation, such judgment must be enforced in accordance with the national rules and procedures of the State of enforcement (usually where the debtor or his/her assets are located, including possibly a requirement for a translation of the judgment to be enforced).

-

Judgments rendered by a court of a country located outside of the EU

In such case, and unless France and the country at stake are bound by a bilateral or multilateral agreement relating to the mutual recognition and enforcement of judgments, the creditor wishing to have his foreign judgment enforced in France must initiate, beforehand, a so-called exequatur procedure.

The exequatur procedure makes it possible to recognize a foreign court decision by obtaining a French judgment of exequatur. Once the judgment of exequatur issues, the foreign creditor may initiate, against the assets of the debtor located in France, all the means of enforcement provided for by French law: essentially seizure of bank accounts, seizure of shares, seizure of ships or aircrafts and even seizure of real estate.

Among such assets, if a French defendant-debtor (natural or legal person) owns French registered trademarks, a seizure of these trademarks can be operated and recorded with the French Patent and Trademark Office.

According to current French legal case-law with regard to foreign non-EU judgments, a foreign judgment will be recognized if it complies with French international regularity principles.

International regularity – as determined by French courts and ultimately the Cour de Cassation/French Supreme Court for civil and commercial matters – basically comprises three conditions: the competence of the foreign jurisdiction, the absence of fraud and compliance with international public policy.

In practice, there shall be no review of the merits of the foreign judgment by the French court. Procedurally, however, a foreign non-EU judgment shall be recognized only if it has effect in the State of origin, and shall be enforced only if it is enforceable in the State of origin.

-

A more rosy future?

It is also important to note that the Hague Convention on the Recognition and Enforcement of Foreign Judgments in Civil and Commercial Matters (the Convention) entered into force on September 1, 2023 following ratification in July 2022 by two contracting parties, the European Union and Ukraine.

The Convention is an international convention that aims to create a common framework for cross-border recognition and enforcement of court judgments between contracting States.

The Convention applies to the recognition and enforcement of judgments in civil and commercial matters.

According to its article 4, a judgment given by a court of a Contracting State (State of origin) shall be recognised and enforced in another Contracting State (requested State) in accordance with the provisions of the Convention. Recognition or enforcement may be refused only on the grounds specified in the Convention and there shall be no review of the merits of the judgment in the requested State.

As long as no other countries outside the EU accede to the Convention, the practical benefits as of September 1, 2023 is limited to the EU Member States’ relationship with Ukraine.

However, things could change in the years to come if the United States decide to ratify the Convention signed by them in March 2022.

The primary interest of the United States in having an international convention on the recognition and enforcement of foreign judgments is to ensure that U.S. judgments are recognized and enforced abroad. Indeed, for the time being, since punitive damages do not exist in French law, a US claimant may have difficulties to recognize and enforce in France the part of the US judgment which grants him/her punitive damages. It remains to be seen if a “full” recognition of this US judgment will be easier to obtain in France after September 1, 2023, date of entry into force of the Convention, notwithstanding the fact that a ratification of the Convention by the United States might only occur after that date.

-

International arbitral awards or awards rendered abroad (France being a signatory of the New York Convention of June 10, 1958 on the Recognition and Enforcement of Foreign Arbitral Awards and of the Washington Convention of March 18, 1965 on the Settlement of investment disputes between States and nationals of other States)

Even if international arbitration awards, as defined and governed under articles 1504 to 1526 of the French Code of Civil Procedure (including those rendered outside France), are in principle final and binding, they are not necessarily subject to voluntary enforcement by the losing party.

If a party obtains a arbitral award and the losing party does not voluntarily enforce it, the winning party may enforce the arbitral award in France against the assets of the losing party located in the French territory including, among others, such overseas territories or “departments” as French Polynesia, Nouvelle Calédonie, Guadeloupe and Martinique.

Enforcement of awards is normally quite easy in France. Indeed, French law allows ex parte recognition of an arbitral award through an exequatur proceeding. Moreover, exequatur proceeding do not afford full review of the award by the French judge. Rather, the award will be enforced once the creditor proves the existence of the award and demonstrates that the enforcement would not breach French international public policy. Once the exequatur proceeding is complete and the losing party is served with a copy of the judgment of exequatur, the losing party may seek to vacate that judgment. However, the exequatur judgment is still enforceable pending the losing party’s challenge of the judgment.

-

The expertise of our law firm

We have a lot of expertise in post-judgment and post-award litigation.

If a foreign judgment or foreign arbitral award is won against a person or company who either cannot be found, defaulted on payment or who simply refuses to pay, then our Office may and will assist with post judgment recovery services.

We can represent clients before all French courts in relation with exequatur proceedings.

In such connection, we work permanently with French ‘Huissiers de Justice’/’Commissaires de Justice who have a monopoly to not only deliver court summons but also to enforce judgments in France -somehow like English bailiffs or US sheriffs- and are authorized to locate and attach debtor assets such as their French bank accounts.

Some of these bailiffs are particularly specialized in the implementation of particularly complex enforcement procedures, such as the seizure of ships (yachts) or aircraft (private jets).

We shall liaise and instruct both official ‘traducteurs jurés’/court listed translators to translate foreign judgments and arbitral awards into French.

Furthermore, if the French debtor is being reorganized or declared bankrupt, we shall timely notify the Creditor’s claim to the Receiver-Liquidator (or petition the Bankruptcy court to obtain a waiver in case of an untimely notification).

Better, we can advise our Clients and their foreign lawyers for all kinds of pre-trial attachments even before a foreign judgment or arbitration award is rendered against their debtor.

Indeed, one of the best ways to enforce a judgment might be to secure assets while a claim is still pending well ahead of the judgment.

A French court can issue a preservation order when the creditor has submitted sufficient evidence to satisfy the court that there is an urgent need for a protective measure because there is a real risk that, without such a measure, the subsequent enforcement of the creditor’s claim against the debtor will be impeded or made substantially more difficult.

Where the creditor has not yet obtained a judgment in an EU Member State ordering the debtor to pay the creditor’s claim, the creditor may also submit sufficient evidence to satisfy the French court that he/she is likely to succeed on the merits of his claim against the debtor.

These preservation measures will be subsequently converted into final securities when the judgment on the merits is rendered. It will then be possible to implement, in the French territory, enforcement measures in order to compel the debtor to pay.

Our Firm may as well initiate, on behalf of its Clients, a European account preservation order procedure to facilitate cross-border debt recovery in civil and commercial matters.

This procedure enables a creditor to obtain a European Account Preservation Order (‘Preservation Order’ or ‘Order’) which prevents the subsequent enforcement of the creditor’s claim from being jeopardized through the transfer or withdrawal of funds held by the debtor or on his behalf in a bank account maintained in a Member State up to the amount specified in the Order.

Finally, our Office shall also professionally determine whether some of the assets of the debtors are subject to freezing measures taken as sanctions against a State or its nationals by France or the European Union as a whole, or even the United Kingdom or the United States (as contemporary examples: freezing measures taken against Iran or Russia).

To conclude, MANDEL & ASSOCIES as a professional legal corporation is well qualified to intervene as ‘Avocats’ before all trial and appellate courts in France, for the following reasons.

- Our knowledge of the exequatur procedure and ensuing enforcement proceedings -and/or, when applicable, of the pre-trial measures, upon judicial petition;

- Our well-known ability to communicate with our foreign Colleagues-Attorneys at law, as well as Patent and Trademark Attorneys, not just in French, English or Spanish, but also in Japanese, Korean and Chinese;

- the various networks to which we belong (such as Eurolegal, a network of Western and Eastern European lawyers);

- and last but not least, membership of Mr. Aimé MANDEL to the State Bar of California and membership of Mrs. Nahoko AMEMIYA to the Tokyo Bar as Bengoshi.